If you have savings, you know it is currently of little use to put it in a savings account. In most countries, it is hardly possible to get more than 1% or even 0.5% interest and usually you pay wealth tax or income tax. Partly as a result of inflation, your money in a savings account actually loses its value over time. But there is also a much sunnier alternative: invest in a luxury property in Spain!

But why invest in luxury real property in Spain right now? The property specialists of Cilo Marbella can give you several valid reasons to invest in real estate in Spain. For more tips and information, you can always download the E-book below, or visit our online guide: Purchasing Luxury Property in Marbella: The Investors Guide.

In this article, we focus on the why…why you should consider investing your hard-earned money in property in the south of Spain.

The Spanish housing market took some serious hits during the previous crisis but has recovered strongly in recent years. Due to the increasing demand, the prices of homes are now rising for the fourth year in a row. Entering and investing in real estate in Spain now can therefore be particularly lucrative, as a further increasing return is also expected for the coming years.

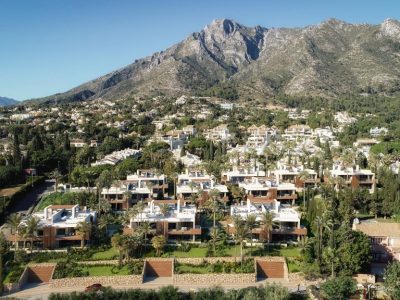

The Costa del Sol real estate market bottomed out in 2012 and began a gradual recovery in 2013 that had accelerated into a new growth cycle by 2015, with strong demand for the new modern villas and apartments being built both then and now. Hard evidence shows that the average prices in the greater Marbella area have not yet reached pre-crisis highs.

Nevertheless, following the corona pandemic and its impact on the global economy, and on top of that the Brexit that has major consequences for the large British community in Spain, experts in El País predict that the prices of homes will fall in the coming year, especially in the previously most popular areas in Spain. This concerns, in particular, the major cities (Barcelona and Madrid) and the most touristy costas, such as the Balearic Islands, Costa Blanca and Costa del Sol. In this regard, the prediction mainly concerns second-hand homes and rentals. New build prices are expected to remain more or less steady due to the high demand.

Despite the Covid-19 pandemic, interest and (remote) sales continue to be strong. Especially in the areas of Marbella, Estepona and Benahavis.

A second reason why real estate in Spain is becoming increasingly popular is the persistently low mortgage interest rates. This is deliberately kept low by the central banks and the expectation is that mortgage rates will not rise quickly for the time being.

The Spanish banks are less and less reluctant to provide mortgages for a part of the purchase price. Because of this, you can currently finance a property in Spain at a fixed low-interest rate, so the monthly costs are low. This makes financing real estate in Spain even more attractive. This also creates extra demand and therefore rising prices.

When you invest in real estate in Spain, you invest in a property in which you can spend your vacations, but you can also generate an income with it. Through vacation rental websites like Airbnb and HomeAway, you can rent out your property to tourists. This way you can recoup your annual costs for e.g. real estate tax and maintenance and even make (considerable) profits.

Letting a house:

Cilo Marbella is renown for its local luxury property rental services in the area of Marbella. We take care of the complete handling of reservations, cleaning and receiving guests for you. This way you don’t have to worry about anything and you benefit from financial advantages, now through rentals and in the future through a possible sale of your Spanish home.

In 2019, the greatest news in a long time for property investors arrived. Not only for Spanish residents but also for non-residents, which will attract new buyers, is that the Inheritance and Gift Tax was virtually eliminated by the Regional Government (Junta de Andalucía) becoming effective from April 11, 2019 with respect to spouses, children, grandchildren and parents (Groups I and II), by subsidizing the tax by 99% which serves as a control tax.

This change makes Costa del Sol a far more attractive destination. Not merely for permanent residents but also for foreign investors and purchasers of holiday homes.

As the Brexit negotiations came to a long-awaited and final conclusion in December 2020, Brexit is now finally a fact. Consequently, many Brits who currently own property, or are thinking of purchasing property, are understandably concerned as to how the situation will directly affect them.

Yes. In fact, as the current legislature stands, Spain does not impose any requirements to be a national of an EU country in order to buy property in Spain. Indeed, there are very few restrictions on ANY country in the world and therefore there should be no effect.

Not applicable for the moment. Property taxes due upon purchase are the same for any buyer, regardless of nationality. While some details are still unsure at the moment (January 2021) this almost certainly remain the same after Brexit. The British are one of the largest market segments for buying Spanish property, so it is extremely unlikely that the Spanish government will do anything to undermine this market.

Let’s allow the real estate offering to evolve and diversify, building on the good news of infrastructural improvements and public works, as well as solid investment into the region that will see new hotels and resorts by prestigious brands add dynamism to a tourist market that still offers homeowners 3-5% net returns on short-term holiday lets.

Not sure what type of property to buy? Download now our free ‘Marbella Living’ brochure. Find the best luxury villas and apartments for sale on the Costa del Sol. From golf to beachfront. From investment properties to ultra-luxurious.

Download your copy here